Using cloud computing, accountants are managing the way they manage outsourcing, financial data and remote working more efficiently.

A number of technologies and innovations have made the lives of accounting professionals easier, such as cloud computing. Cloud-based accounting dramatically reduces the time accountants need to perform basic tasks, unlike traditional accounting, which involves a lot of manual data entry. Aside from reducing accounting processes and increasing accuracy, cloud computing automates some of their functions to ensure streamlined operations. Financial data is managed and operated in a different way thanks to cloud computing. Accountants can benefit from cloud computing in the following ways.

1. A more secure data environment

The data of customers can easily be compromised when filing taxes or handling other highly valuable company information. Accounting professionals should be aware of the threats associated with software, hardware, and communication channels. Because accountants handle sensitive client and company data, cyber security is a concern for them.

With cloud computing, confidential information can be stored in a secure and private cloud where security and privacy can be assured by scheduled upgrades. Financial data stored in the cloud is also protected from natural disasters since it is automatically backed up for easy retrieval after a disaster. All accounting data can be protected from prying eyes with multi-factor authentication, firewalls, and data encryption.

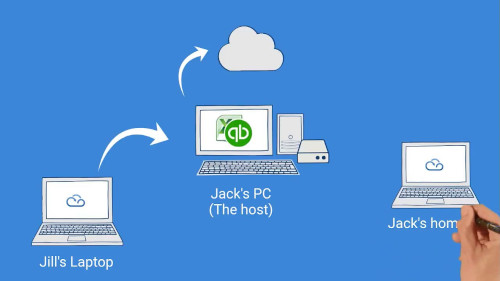

2. Easy data access

Accountants who use desktop-based accounting systems are tied to their offices, since their data, software, and accounts are stored locally.

Data can be accessed from anywhere using cloud computing. In the cloud, accountants can access accounting data and other applications if they have an internet-connected device. Accounting software that is cloud-based allows accountants to access records, reports, ad receipts anywhere and at any time. Accountants can work remotely as a result of this technology.

3. Increases accuracy

By automating most accounting functions, cloud computing reduces human error. By using journal templates, repetitive invoices, and an auto-reserved accrual journal, financial records can be made more accurate, efficient, and accessible.

4. Speeds up operations

Automating routine tasks in the cloud computing system allows accountants to concentrate on other functions, resulting in increased productivity. Automating key processes also eliminates human error and prevents data duplication, which reduces time and effort. Cloud accounting automatically saves and backs up data as you work, so accounting professionals don’t have to waste time saving data or backing it up. A cloud platform eliminates the need for software updates and backups, so accountants are always using the latest software.

5. Collaborating with others

Collaboration is enhanced by accessibility. With desktops, you have limited access to your statements and records, making it difficult to collaborate with colleagues and advisers. Several stakeholders, including team members, management, and advisors, can access books online, allowing the workload to be delegated. A bookkeeper and small business owner can handle simple tasks like paying bills and reconciling their accounts since accountants handle complex functions like long-term forecasting, detailed reporting, and planning. As a result of cloud computing software, accountants are able to offer more services to their clients while doing less work.

6. Paperwork is reduced

Traditional accounting systems require accountants to deal with paperwork and manual data entry, which slows down processes and makes them inefficient. Due to cloud accounting, accountants can significantly reduce their reliance on paperwork by emailing invoices to clients, eliminating printing and postage costs, thereby speeding up payments. It is possible to scan and save receipts and bills in accounting software with their associated transactions. By storing financial statements, reports, and other financial data in the cloud, accountants don’t need to keep original paperwork, saving storage and filing space costs.

7. Customer relationships are improved

It is imperative for accountants to maintain positive relationships with their clients. They can collaborate virtually with clients using cloud computing. Those working with vendors, distributors, and other colleagues can easily find bills, invoices, or identify missed payments. This helps accountants to ensure that all records are up-to-date, easing the tax filing process.

8. Flexible and scalable operations

Cloud computing makes it possible for accountants to scale up or down their resources whenever they need them, so they only pay for the resources they need. Accountants can meet the demands of a growing business using cloud computing. Due to the scalability of cloud computing, they can switch to a more comprehensive accounting solution as their business grows. Additionally, you can integrate add-ons and software options to customize your accounting system.

9. All in one place

In cloud computing, all financial data is stored in one database, allowing everyone to access the same information. There is no need for accountants from different departments to waste time figuring out which spreadsheet to use. This ensures consistency across all financial processes and reports.