Accounting processes are being transformed by integrating advanced technologies and innovative practices. The need for efficiency, accuracy, and adaptability in an increasingly complex business environment is driving this shift as we approach 2025.

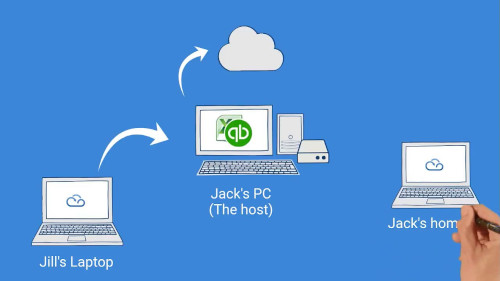

Cloud-based accounting solutions are becoming more popular as firms move away from paper-based records and manual data entry, and MyQuickCloud has been a big part of that shift, helping accountants globally to support teams securely work from anywhere.

With artificial intelligence (AI) and machine learning, large amounts of financial data can be analysed quickly, trends identified, and future outcomes predicted. By using this approach, accountants and accounting firms are able to provide their clients or organizations with better strategic insight.

In addition, cloud computing facilitates collaboration among teams and clients by providing access to financial information in real-time. A significant reduction in fraud risk is achieved through the automation of accounting processes using blockchain technology.

Every accountant should understand the key aspects of digital transformation by 2025 to be able to navigate these changes confidently and effectively. Taking advantage of accounting technology and automating accounting processes will position professionals for success in an evolving market.

Technology’s role in accounting

Technology plays an important role in modern accounting, particularly through digital transformation, which is changing how financial data and operations are managed. FinTech, which includes software and applications designed to smooth accounting processes, has been a key part of this transformation. Invoicing, expense tracking, and payroll can be automated using these tools, reducing human error and saving time.

Artificial intelligence (AI) and machine learning have further expanded the field. Accounting firms and accountants can use artificial intelligence to analyze large amounts of data quickly, providing insights that can help them make informed decisions. In addition, cloud-based solutions enable real-time collaboration and access to financial information anywhere.

Accountants must embrace FinTech and emerging technologies in order to improve accuracy, productivity, and remain competitive. Accountants can leverage these advancements to focus on strategic advisory roles, ultimately increasing their value to clients and organizations. Accountants and accounting firms can deliver more insightful analysis and recommendations through automation of accounting processes.

The key trends shaping accounting technology in 2025

As technology advances, regulations change, and business practices change, the accounting industry is evolving rapidly. Accounting technology trends for the future include:

Automating financial operations with AI and machine learning

- Machine learning and AI can automate repetitive tasks like data entry, invoice processing, and reconciliation, so accountants can focus on more complex analysis.

- The technology provides insights that enable accounting firms and accountants to make informed decisions based on real-time data analysis.

- The use of predictive analytics tools can help businesses predict financial trends and identify potential risks early on.

Accounting Software in the Cloud

- Accountants can access financial data from anywhere, facilitating real-time collaboration with clients and team members.

- In addition to saving money on IT costs, these solutions often result in regular updates and increased security.

- With cloud accounting software, businesses can easily accommodate increasing transaction volumes without significant investments.

Financial Transactions and Blockchain

- With blockchain technology, transactions are secure and transparent, reducing fraud and errors.

- The blockchain can streamline processes, enabling faster settlements and reducing transaction costs by eliminating intermediaries.

- In financial transactions, smart contracts ensure compliance and reduce the need for manual oversight by automating agreements between parties.

The role of digital skills in accounting

Accountants must combine technical expertise with soft skills in order to stay competitive in the profession. Accountants need these essential digital skills:

- To extract meaningful insights from large datasets, accountants need to be proficient in data analysis. Making informed business decisions requires an understanding of data trends.

- Knowledge of accounting software, cloud platforms, and emerging technologies like AI and blockchain is crucial. Financial reporting becomes more efficient and accurate as a result of this proficiency.

- Communication Skills: It is crucial to be able to convey financial information to non-financial stakeholders. It is easier to collaborate and make better decisions when there is strong communication.

- Critical Thinking: Accountants are required to evaluate complex financial situations and make strategic recommendations. The ability to think critically helps solve problems and assess risks.

A successful accounting career requires the ability to adapt to new tools and processes as the industry evolves.

Technology-based learning and adaptation

- Accountants should continue their professional development through workshops, webinars, and certifications to stay up-to-date on industry trends and technology.

- Participating in professional organizations and attending industry conferences can provide valuable insight into emerging tools and best practices.

- In a fast-changing environment, accountants need a proactive mindset about adopting new technologies.

Updates on compliance and regulation

As compliance requirements and regulatory updates change, the accounting and financial landscape continues to evolve. It is important for businesses and accountants to stay informed and adaptable.

New compliance requirements will be implemented

- In 2025, accountants must stay updated on new compliance regulations that affect financial reporting, data privacy, and tax obligations. It is important to understand international standards and local laws, which can differ significantly from one country to another.

- Due to globalization, accountants must navigate complex compliance landscapes across jurisdictions. Cross-border transactions require familiarity with international regulations.

- In financial reporting, transparency is becoming increasingly important. Providing accurate and clear information to stakeholders increases trust and accountability.

Technology’s role in increasing compliance

- Automated compliance tools help accountants stay on top of regulatory changes. The use of these tools can help reduce errors.

- It is possible to identify compliance trends and risks with the help of data analytics, enabling proactive management of potential issues before they become a major issue.

- As a result of technology, financial information is increasingly secure, ensuring it is protected from breaches, which is essential for maintaining compliance with data protection laws.

The importance of cybersecurity

Increasing digitisation of financial data makes cybersecurity an essential component of protecting sensitive information and ensuring trust. Consider these factors:

Protecting data in the digital age is essential

- In addition to handling sensitive financial data, accountants are prime targets for cybercriminals. Identity theft and financial fraud can be prevented by protecting this data.

- The consequences of a data breach can be severe, including loss of trust, legal penalties, and significant financial losses. For this reason, maintaining robust cybersecurity measures is imperative to protecting client information as well as the reputation of the firm.

Mitigating cyber security risks

- Assess your digital infrastructure regularly to identify vulnerabilities. Configuring software, hardware, and networks is part of this process.

Implement ongoing training programs for employees to educate them about the latest cyber threats, such as ransomware and phishing. - You can use MFA (Multi-Factor Authentication) to ensure that you are protected even if your password is compromised. Encrypt sensitive data in transit as well as at rest to prevent unauthorised access.

- The most effective way to recover data if the system fails or is attacked by ransomware is to maintain regular backups of critical data.

Hybrid Work Environments: A Shift in Workstyles

Business models, including accounting, are changing as a result of hybrid work models. This shift is affecting the industry in the following ways:

Accounting Practices Impacted by Remote Work

- Using remote work has transformed traditional accounting practices by enabling professionals to access financial data from anywhere. Flexible decision-making allows for quicker client response.

Collaboration and flexibility must be balanced

- Despite remote work’s advantages, it can also challenge team cohesion and communication. For example, accountants can use cloud-based tools to share real-time data and conduct virtual meetings to foster collaboration.

- Team members can stay aligned while working remotely by creating clear guidelines and regularly checking in. In order to ensure productivity and success, accounting firms can create hybrid work environments that balance flexibility with collaboration.

It’s not just about technology that drives digital transformation, but also about changing customer expectations and connections. Implementing advanced technologies and techniques can help accountants provide greater value to their clients, increase client trust, and maintain their role in a rapidly changing industry.

How MyQuickCloud can support your accounting firm

In today’s fast-paced business environment, accountants face significant challenges when hiring remote workers, whether temporarily or permanently. The process of purchasing laptops, configuring them with necessary applications, managing delivery logistics, and ensuring ongoing technical support is both time- consuming and resource-intensive. Moreover, many businesses lack the technical expertise to effectively secure these devices, which makes their organization fragile.

We offer a game-changing solution with MyQuickHub – a dedicated cloud space tailored to your company’s needs. With MyQuickHub, you can seamlessly host up to 20 users, each with their personalized workspace, called MyQuickBoard.

Every MyQuickBoard comes pre-configured with the required applications, allowing you to effortlessly manage employee access. Your team can use their own devices or a basic laptop equipped with just a web browser or the MyQuickCloud app. All desktop applications are securely hosted in the cloud, eliminating the need for complex, on-site setups. We have customers in over 20 different countries. Our primary focus is on the U.S, Canada and UK.

We deliver an easy, secure, and cost-effective solution you can trust for your accounting firm at www.myquickcloud.com