Businesses can solve the skills gap through offshoring. How do you choose the right partnership, and what are the best conditions and technology?

It’s important to distinguish between outsourcing and offshoring. Outsourcing occurs when a company hires a third party to handle a specific process, finding a specialist in that field. In outsourcing, work is outsourced to a contractor in another country to lower costs or take advantage of more skilled workers or greater flexibility.

Offshoring as a business strategy

Offshoring can reduce operational and staff costs, and access to skills that are not available in-house can be provided by it. Keeping track of compliance issues allows the contractor to focus on strategic work, freeing the company’s team.

According to Simon Rowe, director of DGFinco, the offshoring and outsourcing finance arm of Milsted Langdon, many firms have changed their mindsets.

“In the past, the reasons for offshoring centred around cost and an immediate improvement of the bottom line – it is now a way for businesses to be more flexible,” he says.

Many businesses (including accounting firms) take advantage of offshoring to obtain the resources they need to deliver to clients due to the tight employment market.

Ultimately, whether or not outsourcing is the right choice will depend on the specific needs and circumstances of the accounting business.

Due diligence

Before signing any contract, it is crucial to conduct proper due diligence. Communication and reporting must be clear between businesses and their outsourced compliance partner.

According to Peter Hucker, head of operations at cloud-based finance software company Xledger UK, there are many factors to consider. “Any due diligence should not just cover the cyber security credentials of any supplier, but any third parties involved in the handling of their data,” he warns.

“When handling data across borders, look for suppliers who hold internationally recognised standards such as ISO 27001 (information and security). This can give organisations comfort that they are working with partners who understand the importance of keeping their data safe. Organisations collecting personal data should also carefully consider the handling of their data from a GDPR perspective.”

Offshoring as a business strategy

Offshoring can reduce operational and staff costs, and access to skills that are not available in-house can be provided by it. Keeping track of compliance issues allows the contractor to focus on strategic work, freeing the company’s team.

According to Simon Rowe, director of DGFinco, the offshoring and outsourcing finance arm of Milsted Langdon, many firms have changed their mindsets.

“In the past, the reasons for offshoring centred around cost and an immediate improvement of the bottom line – it is now a way for businesses to be more flexible,” he says.

Many businesses (including accounting firms) take advantage of offshoring to obtain the resources they need to deliver to clients due to the tight employment market.

Ultimately, whether or not outsourcing is the right choice will depend on the specific needs and circumstances of the accounting business.

Due diligence

Before signing any contract, it is crucial to conduct proper due diligence. Communication and reporting must be clear between businesses and their outsourced compliance partner.

According to Peter Hucker, head of operations at cloud-based finance software company Xledger UK, there are many factors to consider. “Any due diligence should not just cover the cyber security credentials of any supplier, but any third parties involved in the handling of their data,” he warns.

“When handling data across borders, look for suppliers who hold internationally recognised standards such as ISO 27001 (information and security). This can give organisations comfort that they are working with partners who understand the importance of keeping their data safe. Organisations collecting personal data should also carefully consider the handling of their data from a GDPR perspective.”

Here’s how to do it

1 Decide which tasks you can and should outsource

Consider why you want to offshore and why you need to offshore. Are we trying to save time and money here? To accomplish tasks that cannot be completed internally due to a lack of skills? Is there a shortage of talent?

2 Research your topic

On social media and at networking events, ask other accountants what companies they use. What kind of partner would be a good fit for you? What is the reputation of the person? You need to want to work with them – it’s not just about skills.

3 Ensure your qualifications and skills are robust

To avoid delays that could cause internal chaos and annoy clients, you need to make sure the company you’re using has qualified staff to deliver the quality you demand.

4 Try outsourcing small tasks first as a trial

Both parties can benefit from a trial period of two or three months. Once the decision has been made, start small. Then you will be able to assess the quality of work and get used to managing the relationship.

5 Maintain transparency with clients

As long as the quality of the work remains the same, clients may not need to know about offshoring. Clients will, however, be concerned about their data and who exactly oversees their accounting needs. Communicate what due diligence has been undertaken and how their data is protected.

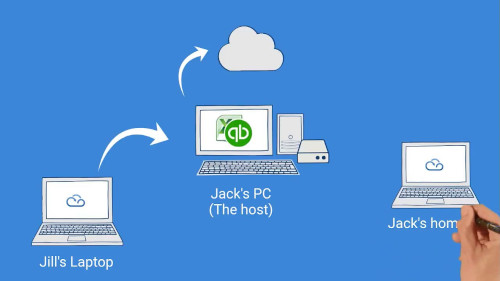

6 Set up MyQuickCloud

Work from anywhere with a fully managed cloud desktop solution.

We enable small businesses to centralise and collaborate with in-house and offshore teams.

Improve the productivity of employees with secure access to a virtual private desktop and a familiar end-user experience. Improve on-premise and remote worker productivity with a fully functional desktop accessible from any location and at a simple flat monthly fee and the ability to add or remove users monthly whenever necessary.

Find out more about he we support accountants here.