Outsourcing and offshoring may be used interchangeably, but they are not the same thing. MyQuickCloud explain everything in detail.

Finance professionals have benefited from outsourcing long before it was even a term. In practice, accountants provide payroll services as a bureau service, and among the first to use IT to do so.

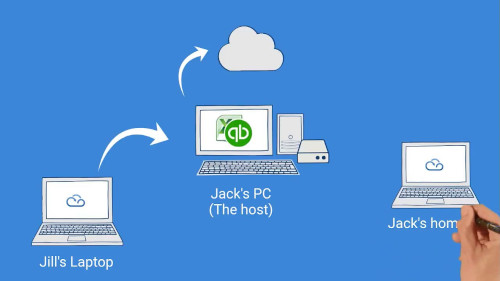

Outsourcing has evolved as a result of IT. The concept gained popularity in the late 1980s when many technology companies outsourced their customer service functions to IT. Various non-core business functions, such as accounting, customer support, facilities management, finance, human resources, and IT, are now handled by external specialists with its support.

People often use the terms outsourcing and offshoring interchangeably, but they mean different things. The transfer of organizational functions to a third party is known as outsourcing, but it is also called offshoring when that third party is located abroad. As an additional complicating factor, offshoring can also refer to the transfer of work to another country, but with the work remaining within the organization rather than being outsourced. In order to clarify, offshore outsourcing refers to outsourcing work to a third party located in another country.

While these various terms of reference may be confusing, they are unified by common underlying motives: the need to reduce operational costs and complexity. Offshoring of secretarial support and data analysis services is becoming increasingly popular because of the business advantages of doing work overnight.

Offshoring and outsourcing can affect finance professionals emotionally. A company needs fewer highly skilled accountants when it outsources its entire finance function or replaces multiple national finance departments with an international shared services center. Finance professionals in China or India seem to benefit most from offshored accounting functions or jobs from Europe or the US.

These trends are no exception to the rule that change rarely benefits everyone. The changes may force some experienced accountants out of their comfort zones, but they also offer opportunity for part- and newly-qualified ACCAs around the globe – so take advantage of them.